Expense tracking apps turn financial chaos into clear insight, giving you control over your spending and helping you achieve your financial goals. These apps do not only record expenses, they analyze spending patterns, create smart budgets, and provide deep insights that support informed financial decisions. Whether you are a student managing a monthly allowance, a family head planning for the future, or a professional tracking business expenses, these tools provide the transparency and control needed to achieve financial stability.

Criteria for Choosing Expense Tracking Apps

When comparing expense tracking apps, essential criteria emerge that determine the quality of a financial tool. While apps vary in interface simplicity and feature sets, accuracy in recording transactions and data security remain the cornerstone of selection. When comparing the strength of budgeting tools and bank account integration, priority depends on whether the user seeks detailed analysis or simple management. As for advanced reports versus smart notifications, both serve different goals in the journey toward financial awareness.

| Criterion | Relative Importance | Impact on Financial Management | Available Alternative |

|---|---|---|---|

| Security and Privacy | Very High | Protection of sensitive financial data | Apps with weak security |

| Tracking Accuracy | Very High | Ensuring correct transaction recording | Error-prone manual logging |

| Budgeting Tools | High | Planning and monitoring spending | Random management |

| Bank Integration | Medium to High | Automatic account updates | Manual entry |

| Analytical Reports | High | Understanding spending patterns | Superficial reports |

| Smart Notifications | Medium | Alerts for budget overruns | Manual monitoring |

| Currency Support | Medium | Suitability for international users | Single currency only |

| Free Version | High | Accessibility for everyone | Mandatory subscriptions |

What Are the Top 10 Expense Tracking Apps?

Expense tracking apps are not just logging tools, they are personal financial advisors guiding you toward financial stability. They were selected based on their ability to meet diverse needs, from simple tracking to advanced analysis. Among the best money management apps:

- Mint (Mint)

- Wallet (Wallet)

- Spendee (Spendee)

- Money Manager (Money Manager)

- Expense IQ (Expense IQ)

- Goodbudget (Goodbudget)

- AndroMoney (AndroMoney)

- Money Lover (Money Lover)

- Mobills (Mobills)

- CoinKeeper (CoinKeeper)

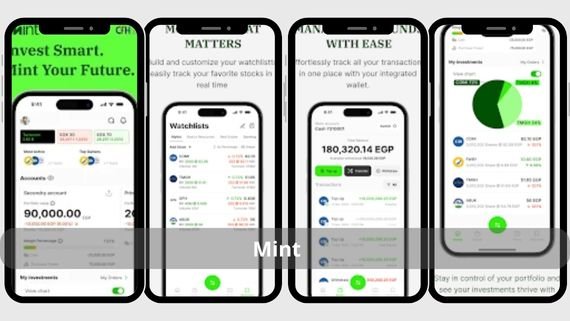

Mint App (Mint)

Mint is considered a pioneer in the world of financial apps, combining expense tracking, budget management, and credit monitoring in one platform. Its ability to automatically integrate with bank accounts and categorize transactions makes it the ideal choice for those seeking a comprehensive and automated solution. Below are the key features of the Mint app:

- Automatic linking with bank accounts and cards

- Automatic categorization of expenses by category

- Create and track multiple budgets based on needs

- Free credit score monitoring with periodic reports

- Bill and budget overrun notifications

- Detailed reports on monthly and yearly spending

- Personalized financial tips based on spending patterns

- Ability to set and track savings goals

- Support for managing debts and loans

- Simple and easy-to-use user interface

Easily track your investments with Mint 💰 a smart app for managing your financial portfolio!

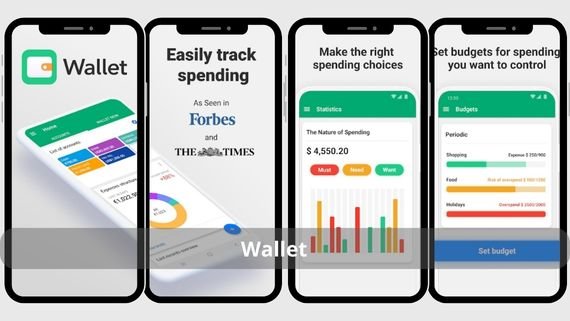

Wallet App (Wallet)

Wallet offers an elegant and intuitive user experience with powerful expense management features. It stands out with its ability to track daily expenses, create flexible budgets, and deliver interactive visual reports. Below are the key features of the Wallet app:

- User-friendly and attractive design suitable for all users

- Interactive charts that illustrate spending patterns

- Cloud synchronization across all devices for access anywhere

- Multi-currency support for international users and travelers

- Set and track personal financial goals

- Support for managing income and expenses in one place

- Export data in multiple formats (PDF, CSV, Excel)

Control your spending and budget with Wallet 💳 a smart personal finance management app!

Spendee App (Spendee)

Spendee stands out with its visual approach to money management, turning financial data into colorful and easy-to-understand charts. Its ability to create shared budgets and track group expenses makes it ideal for couples and families. Below are the key features of the Spendee app:

- Attractive visual representation of financial data with colorful charts

- Manage shared budgets for couples, families, and friends

- Scan receipts and automatically categorize them using the camera

- Detailed monthly summaries of spending and income

- Export data in multiple formats for external analysis

- Smart notifications for bills and financial deadlines

- Track financial goals and progress

- Modern and easy-to-use user interface

Monitor your expenses and budget easily with Spendee 📊 a smart expense tracking app!

Money Manager App (Money Manager)

Money Manager is a powerful personal accounting app that provides precise control over all aspects of money. It features double-entry accounting functions, debt and loan management, and comprehensive reports. Below are the key features of the Money Manager app:

- Integrated accounting system with double-entry accounting functions

- Comprehensive tracking of loans and debts with repayment schedules

- Deep financial analysis and detailed reports

- Create custom budgets based on needs

- Detailed categorization of expenses and income

- Multi-currency support for international users

- Ability to create custom reports by period

- Professional user interface suitable for professionals

Organize your expenses and budget efficiently with Money Manager 💰 a smart money management app!

Expense IQ App (Expense IQ)

Expense IQ combines simplicity and power in one app. It features a clean and easy-to-use interface with advanced tools such as expense tracking, budget management, and detailed reports. Below are the key features of the Expense IQ app:

- Beginner-friendly interface with a clean and organized design

- Daily, weekly, and monthly spending summaries

- Create smart budgets with overrun alerts

- Reminders for due payments and bills

- Easy export of reports in multiple formats

- Smart notifications for budget overruns

- Charts that illustrate spending patterns

- Data protection with password security

Control your spending intelligently with Expense IQ 🧾 a practical expense and budget management app!

Goodbudget App (Goodbudget)

Goodbudget follows the digital envelope budgeting system, dividing your income into predefined spending categories. This approach makes it ideal for those who want strict control over their spending. Below are the key features of the Goodbudget app:

- Divide income into predefined spending categories

- Share budgets with family members in real time

- Clear and straightforward reports on spending and savings

- Set savings goals and track progress

- Clean user experience without intrusive ads

- Ability to create custom budget categories

- Multi-currency support for international users

- Cloud synchronization across all devices

- Smart notifications for budget overruns

- Simple and easy-to-understand user interface

Plan your budget smartly with GoodBudget 📒 an easy and effective expense planning app!

AndroMoney App (AndroMoney)

AndroMoney is a powerful and reliable expense management app, distinguished by its support for multiple currencies and languages, making it suitable for international users. Below are the key features of the AndroMoney app:

- Multi-currency and multi-language support for international users

- Comprehensive financial analysis and detailed reports

- Cloud data storage for access from anywhere

- Create custom budgets based on needs

- Data protection with password or fingerprint

- Ability to manage multiple accounts in one place

- Support for creating custom expense categories

- Export data in multiple formats for analysis

- Charts that illustrate spending patterns

- Professional and organized user interface

Track your expenses and manage your money easily with AndroMoney 💵 a smart personal finance app!

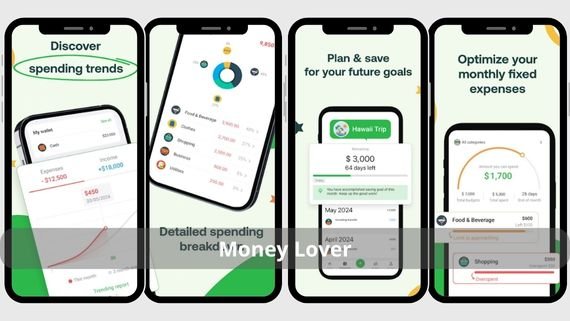

Money Lover App (Money Lover)

Money Lover combines an attractive interface with powerful money management features. It stands out with its ability to track expenses, manage budgets, and provide smart financial advice. Below are the key features of the Money Lover app:

- Modern and attractive design that is easy to use

- Personalized financial tips based on spending patterns

- Create smart budgets with overrun alerts

- Interactive charts that show financial status

- Device synchronization for access anywhere

- Ability to create specialized expense categories

- Support for managing debts and loans

- Track financial goals and progress

- Smart notifications for bills and deadlines

Control your budget and expenses smartly with Money Lover 💸 a comprehensive money management app!

Mobills App (Mobills)

Mobills is a popular Brazilian app that gained global recognition thanks to its simplicity and effectiveness. It excels at tracking expenses, managing bills, and providing clear reports. Below are the key features of the Mobills app:

- Simple and straightforward interface suitable for all users

- Effective management of bills and financial schedules

- Easy-to-understand reports that show financial status

- Create simple budgets suitable for beginners

- Reminders for bills and important deadlines

- Charts that illustrate spending patterns

- Export data in multiple formats for analysis

- Data protection with password

Plan your expenses and budget easily with Mobills 📊 a smart app for effective money management!

CoinKeeper App (CoinKeeper)

CoinKeeper offers a unique user experience with a dashboard-style interface, making money management fun and interactive. It excels at tracking expenses, creating budgets, and providing visual insights. Below are the key features of the CoinKeeper app:

- Interactive dashboard-style design that makes management enjoyable

- Visual representation of financial status with clear charts

- Create custom budgets based on needs

- Instant and quick reports on financial status

- Set and track personal financial goals

- Ability to create custom expense categories

- Support for managing multiple accounts in one place

- Smart notifications for bills and deadlines

- Data protection with password or fingerprint

- Modern and attractive user interface

Track your expenses and money easily with CoinKeeper 📊 a fun and practical financial tracking app!

Choosing the Best Expense Tracking App for You

With many expense tracking apps available on Google Play Store, choosing the right app becomes challenging. The best choice depends on several factors such as usage type, level of detail required, and the need for bank account integration. The following comparison table helps you choose the app that best suits your needs:

| App Name | Advantages | Disadvantages |

|---|---|---|

| Mint | Bank integration, automatic categorization, credit reports | Not available in some countries |

| Wallet | Intuitive interface, visual reports, multi-currency support | Some features require a paid subscription |

| Spendee | Visual representation, shared budgets, receipt scanning | Limited features in the free version |

| Money Manager | Double-entry accounting, debt management, advanced reports | Complex interface for beginners |

| Expense IQ | Simple interface, daily reports, smart budgets | Limited advanced features |

| Goodbudget | Envelope system, family sync, ad-free | Requires manual transaction entry |

| AndroMoney | Multi-currency support, advanced reports, high security | Somewhat outdated user interface |

| Money Lover | Attractive interface, smart tips, smart budgets | Some features require a paid subscription |

| Mobills | Simplicity, bill management, clear reports | Limited advanced features |

| CoinKeeper | Interactive interface, visual insights, financial goals | Limited bank account integration |

Choosing the right expense tracking app is an important step toward achieving financial awareness and stability. It is recommended to try several apps to select the one that best fits your specific needs and to take advantage of advanced features to gain maximum control over your finances.