Money Lover is the ultimate personal finance companion trusted by over 10 million users globally. This comprehensive money management platform transforms how people track spending, create budgets, and achieve financial goals. From daily expense logging to debt management and savings tracking, Money Lover provides an all-in-one solution for complete financial control and insight.

Why Choose Money Lover?

Money Lover earned Google’s Top Developer recognition and consistent Editor’s Choice awards since 2016 for delivering exceptional user experience combined with powerful financial tools. The app excels at simplifying money management through intuitive interfaces, intelligent budgeting with predictive spending analysis, and robust security with biometric protection. Users benefit from automatic bill reminders, multi-wallet organization, and seamless synchronization across all devices and platforms.

- Automatic Bank Sync: Connect bank accounts for real-time transaction updates across supported countries. Eliminates manual entry and reduces tracking errors significantly.

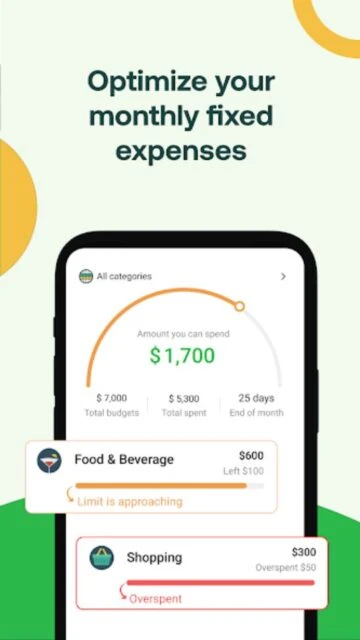

- Intelligent Budgeting: Predictive algorithms analyze spending history to suggest realistic budgets. Visual tracking helps users stay within limits and identify overspending patterns.

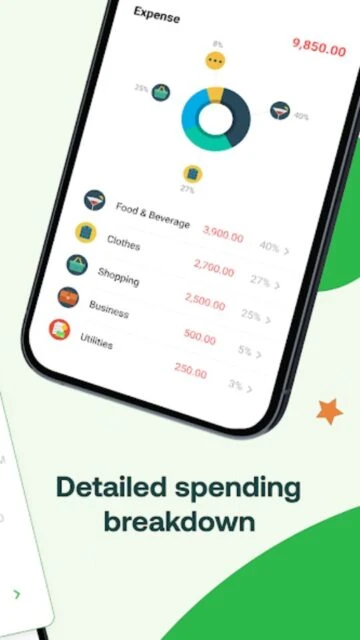

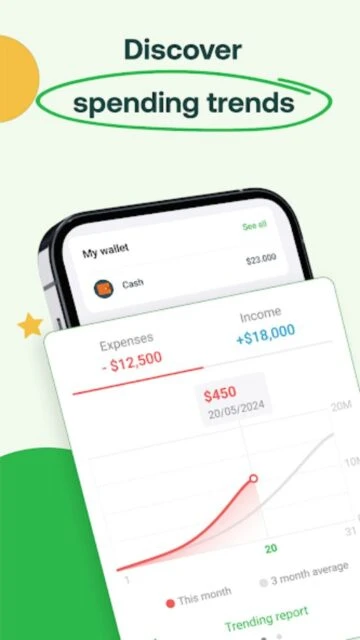

- Comprehensive Reports: Detailed financial visualizations including income breakdowns, expense categories, and savings progress. Export data to Google Sheets for advanced analysis.

How It Works

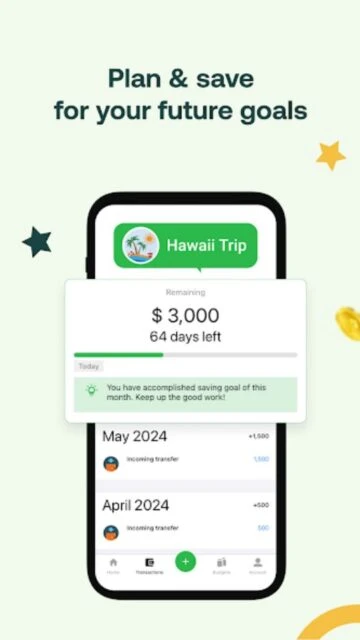

Users create wallets for different purposes and manually enter transactions or enable automatic bank sync for real-time updates. The app categorizes spending automatically, tracks recurring bills with smart reminders, and manages multiple credit cards efficiently. Built-in goal setting features help visualize savings progress while the savings wallet enables dedicated goal tracking with interest calculations.

Who Should Use It?

Money Lover suits individuals seeking comprehensive money management, families coordinating shared finances through wallet sharing features, and international users with multi-currency needs. Ideal for users wanting automatic bank integration, detailed spending insights, and goal achievement tracking. Perfect for anyone overwhelmed by financial complexity seeking simplified, visual money management.