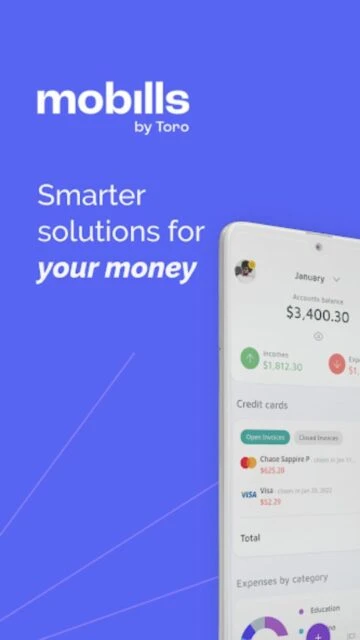

Mobills is a comprehensive budget planner designed to help users take complete control of their personal finances in one centralized dashboard. With over 10 million downloads, this app combines intuitive expense tracking with powerful financial management tools. Users can create custom monthly budgets, track spending patterns, and organize their entire financial life from a single screen with real-time insights and detailed analytics.

Why Choose Mobills?

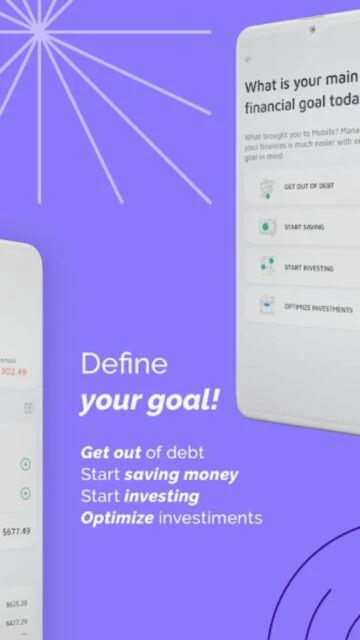

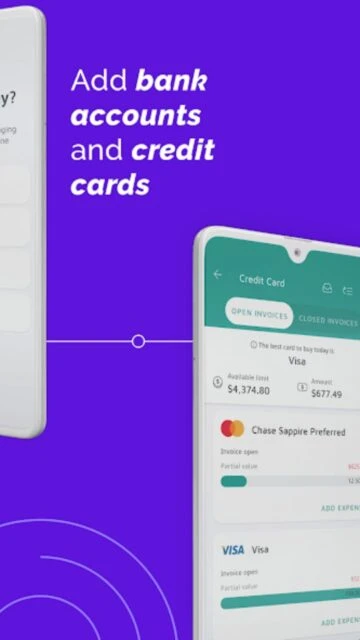

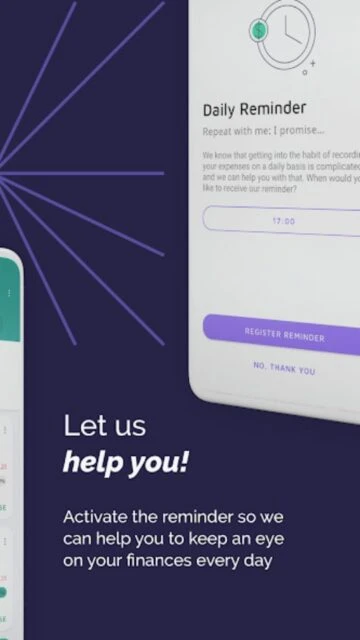

Mobills stands out by offering a complete financial management solution without overwhelming complexity. The app delivers actionable insights through customizable graphs and reports, helps users understand spending patterns, and prevents overspending through intelligent budget planning. Users benefit from advanced filtering capabilities, multi-device cloud synchronization, and dedicated bill payment alerts that ensure no due date is ever missed. Premium subscribers unlock credit card management for multiple cards, geolocation-based expense tracking, receipt storage, and comprehensive financial goal management features.

- Smart Budget Planning: Create personalized budgets aligned with your income and financial goals

- Credit Card Mastery: Track multiple cards, limits, and due dates in one unified interface

- Cloud Sync Across Devices: Seamlessly access your financial data online or offline from any device

How It Works

Users begin by setting up their accounts and defining expense categories that match their lifestyle. The intuitive interface makes adding transactions effortless, whether from bank integrations or manual entry. Mobills automatically categorizes spending, generates detailed reports, and sends bill payment reminders. Users can set monthly budget limits per category, monitor progress in real-time, and receive alerts when approaching or exceeding budget thresholds to maintain financial discipline.

Who Should Use It?

Mobills is ideal for individuals seeking comprehensive financial control without technical complexity. It suits people managing multiple credit cards, those wanting to reduce spending through detailed tracking, families coordinating shared budgets, and anyone striving to achieve specific financial goals. Whether starting a budget from scratch or optimizing existing spending, Mobills provides the tools and insights needed for informed financial decision-making.